Our cooperation greatly supported completing the first and the most difficult of the three stages of the planned work on the application.

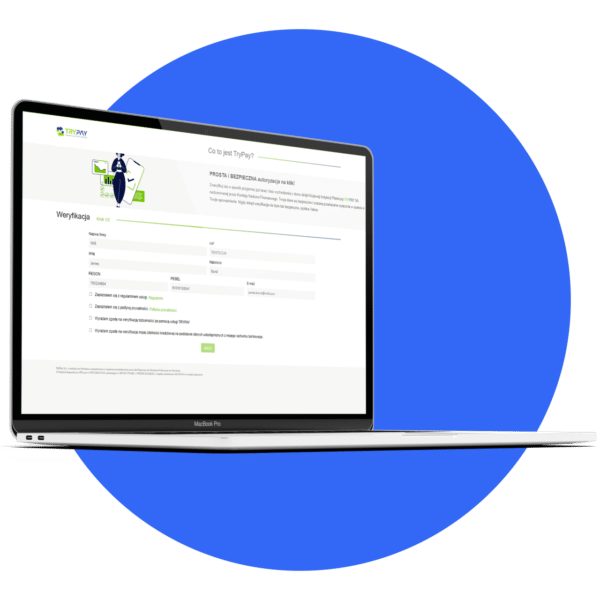

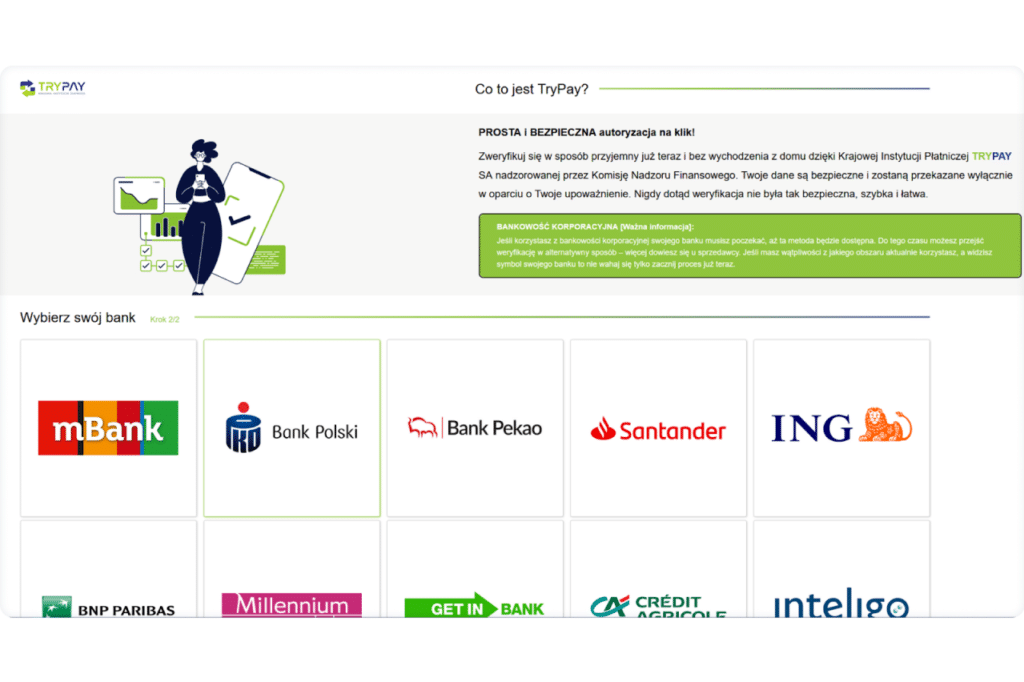

Despite the high project complexity, the team created a secure, scalable, and efficient system with advanced architecture and many integrations in 9 months. Our team coped with the most significant challenge at this stage – we integrated TryPay with 13 banks based on PolishAPI. Another achieved goal is providing the shortest possible process path on the end client’s side. The system is intuitive and easy to use, with a friendly API (plug & play). We also consider complete automation and objectivity of verifying decisions as our success. The null direct costs of manual verification by analysts during credit scoring are also worth mentioning. It translates not only into financial benefits but also a significant reduction in the loan granting process – the decision takes a few seconds, thanks to the process automation.

The end of the first stage of work doesn’t mean that TryPay and Deviniti cooperation is concluded.

The interdisciplinary team is already in the process of further work: we are developing business processes and data analysis while preparing the deferred payment, installment payment, and liability repayment process. We are also working on AI algorithms – building new models and collecting data from current implementations. In addition, we are already introducing the system to the first clients: one of the largest Polish B2B stores and online loan providers.